It’s about creating opportunities currently at TRL 7 or early commercialisation stages.

We seek out startups where scientific ingenuity meets venture-scale returns. Our portfolio companies are built on fundamental discoveries—not iterations—with IP that defines new asset classes.

Opportunities are mainly based on rewriting industry rules by delivering radically better value and creating entirely new markets rather than just capturing existing ones.

Their Potential? Turning industry assumptions into vulnerabilities.

Opportunities are mainly based on rewriting industry rules by delivering radically better value and creating entirely new markets rather than just capturing existing ones.

Their superpower? Turning industry assumptions into vulnerabilities.

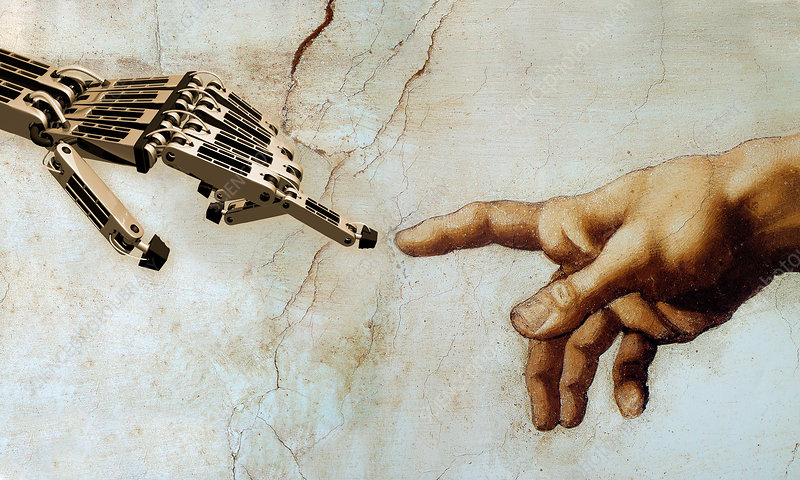

For DB Ventures, systemic impact means greater value. It challenges outdated economic structures, democratises access to resources, and shifts value creation toward people and the planet.

Consumer expectations are shifting. Regulatory environments are evolving. And traditional systems are under strain. The next wave of growth will belong to those who reimagine how business is done.

Our unique five step approach brings security to investors and founders going forward.

To support our five step approach on portfolio selection, Dark Bridge Ventures uses a growing team of industry and technology specialists to add another layer of scrutiny and validation to potential portfolio members.

Why It Matters

The green economy is an economic model that prioritises sustainable development and infrastructure, circularity, clean energy, and governance to protect the environment, and promote resilient societies while creating wealth.

DB Ventures provides a portfolio of business opportunities based on disruptive companies and technologies:

Investment Summary

Dark Bridge Ventures is pleased to present an attractive investment opportunity in a North American cybersecurity firm. This company has pioneered a novel methodology for the assurance and verification of chipset OEM status within technical hardware, thereby creating a new, unexploited branch of cybersecurity.

Industry: Chipset Level Cyber Security System

Valuation & Offering:

Market Overview

The cybersecurity market, valued at USD 245B in 2024, is rapidly expanding due to rising cyber threats, digital transformation, and regulations like NIS2. Projected to nearly triple to USD 500-563B by 2030 (12.9-14.4% CAGR) and exceed USD 697B by 2035 (11.3% CAGR), growth is fueled by IoT, quantum computing risks, and a talent shortage, demanding innovative, scalable defenses.

Company Overview

The company offers chipset-level hardware assurance to verify and validate technology supply chains. Their proprietary, field-proven technology quickly and non-destructively assesses hardware for counterfeits and embedded issues, protected by a «Data Moat» of signatures, interrogation methods, and IP. All generated data remains property of the customer and always under customer control.

Business Model

Use of Funds

They are seeking USD 5 in Series A funding to strengthen technology, grow the team to 30 full-time employees, and scale operations.

Traction

The company has pilots and contracts with US government agencies (US Army, US Air Force, DoD), and their technology is being applied in aerospace (drone controllers) and energy grid protection. They won a 450 SCRM Tool Bakeoff at the US Department of Defense.

Team

The leadership team includes experienced individuals in cybersecurity, national security, digital forensics, and business.

Conclusion

Build the secure foundation of tomorrow’s technology and unlock the returns as an early investor in a new and rapidly expanding market.

This company presents a strong investment opportunity:

Investment Summary

Dark Bridge Ventures is pleased to present a compelling investment opportunity in a northern european company with advanced high-quality protein production for animal feed using only CO₂, and hydrogen.

Having completed extensive due diligence on both the technical and management teams, we are confident in their industry expertise, strategic market positioning, and strong interest by major sector players in Norway, USA and Asia.

Industry: Fermentation-Derived Protein

Valuation & Offering:

Market Overview

Fermentation-derived protein is no longer just a laboratory concept; it is an emerging industrial sector with multiple companies executing on scaling plans and building the first generation of commercial production plants driven by demand for sustainable ingredients in feed, aquafeed and food.

Numerous companies are now executing scaling plans for first-generation commercial plants with major industrial players like Saudi Investment Group (SIIG), Mitsubishi, and Gulf Biotech signal strong sector confidence and validate its significant growth potential.

Company Overview

The company has developed a groundbreaking technology that produces high-quality protein for animal feed using only CO₂, and hydrogen or ammonia.

Its proprietary reactor design enables safe, efficient gas fermentation at scale, positioning the company to capture a segment of the $60+ billion global aquafeed market and the $50+ billion premium pet food market with a fully sustainable, land-independent protein source.

The company is perfectly suited to eventually enter the human food sector because of its core advantages adding access to the $1 trillion+ market.

The company’s main achievement:

Business Model

Use of Funds

Plant for 2.000 (two thousand) T/Y and expanding engineering and business development teams to secure partnerships globally for stage 1 and stage 2 described below.

Traction

Site secured and permissions granted to develop one large-scale project in two stages with large distributors across the globe ready to negotiate the intake

Team

Highly seasoned team with deep expertise in industrial biotechnology, fermentation, and global feed markets, supported by a strategic holding company with aligned investments in sustainable food production in northern Europe.

Conclusion

The company has far more advanced technology than their competitors with extremely high chances to dominate the market in the next 2-3 years.

The valuation is fairly low compared to competitors with inferior technologies.

The market is scaling up and plenty of early adopters are taking positions with competitors with lesser advanced technologies.

Investment Summary

Dark Bridge Ventures is pleased to present a compelling investment opportunity in a northern European company with advanced salmon aquaculture technology poised for scaling.

Having completed extensive due diligence on both the technical and management teams, we are confident in their industry expertise, strategic market positioning, and strong interest by major sector players in Norway, China, Japan and middle east.

Industry

Inland salmon aquaculture by Recirculating Aquaculture Systems (RAS).

Valuation & Offering

Market Overview

Inland salmon farming, using Recirculating Aquaculture Systems (RAS), is transitioning from a promising concept to a commercial reality. The sector has faced high costs and technical setbacks but several large-scale facilities are now operational and ramping up production, proving the model’s viability including the impressive 100.000 T/Y in Saudi Arabia.

The global salmon market is valued at approximately $20 billion annually, with a production volume of roughly 2.8–3.0 million metric tons, dominated by Norway and Chile, and driven by strong demand from the EU, US., and growing Asian markets.

Company Overview

This company has significantly lowered the barriers to entry for land-based aquaculture by offering:

The company’s main achievement towards scale up:

Business Model

Use of Funds

The company is seeking investment to expand engineering and business development teams and secure additional project partnerships for the three projects planned:

Team

Note

The parent holding company maintains a strategic portfolio of investments within the salmon industry, with the explicit objective of establishing a leading position in the sustainable salmon production market.

A serial innovator entrepreneur with a proven history of pioneering change across industries and cultures combining strategic foresight, disruptive thinking, and a relentless drive to transform ideas into tangible impact.

With 25 years of experience spearheading cutting-edge solutions, he thrives at the intersection of creativity and execution, turning visionary concepts into market-defining realities.

His passion for exploring and learning has taken him to over 60 countries, where every culture has sharpened his global mindset. The journey continues—because the best innovators never stop discovering.

For Benjamin, no angle on clean energy, sustainability, or tech is taboo. Far-out ideas are fodder for a wider frame on the world and for identifying new opportunities. From physics and chemistry, to new social models and ways of making life fulfilling–the possibilities luckily never end. But it can be difficult to explain what’s in your head. Turning that spark of creativity into a concrete vision and then into a product that changes the way we think and the way we live–that’s how Benjamin illuminates the dark bridge.

Outside of technology and science, Benjamin is a writer, climber, and musician. He is currently turning an old academic project on the history of energy into a new popular science book and writing news articles on the human rights of clean energy. And if you’re interested in ammonia, click here.

Ashton brings over 25 years of business and investment expertise in renewable energy, clean technology, and ESG finance. He has successfully originated, launched, and financed start-ups, and developed partnerships with key industry players. Additionally, he has negotiated power agreements that align with long-term sustainability objectives, focusing on business development, client relationships, and strategic planning.

As an accomplished oarsman, Ashton has achieved top club-level status in the UK and regularly competed at the Henley Royal Regatta, notably securing a significant victory in 1998. His passion for the outdoors and the natural world has led him to climb Mount Kilimanjaro and undertake rafting and trekking expeditions in the Zanskar Gorge of the Himalayas. After residing in southwestern France for a decade, Ashton recently relocated to Barcelona, where he now lives with his family.